What is the Dubai Investor Visa?

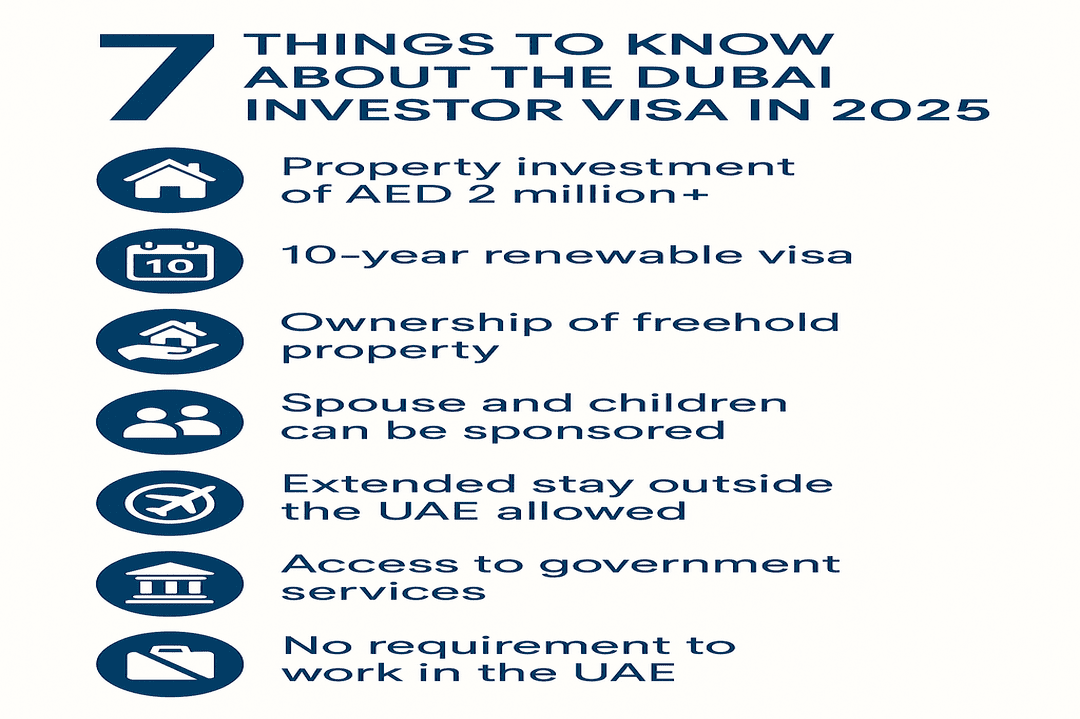

The Dubai investor visa is your shortcut to living, working, and investing in one of the world’s fastest-growing cities. In simple terms, it’s a long-term residence visa you can get if you invest money in Dubai—usually in property, a business, or certain government-approved funds.

So, what makes it special? Unlike many other visas, the Dubai investor visa isn’t just for business tycoons. Regular people, entrepreneurs, freelancers, and even first-time investors can apply if they meet the basic requirements.

Here’s the real appeal:

- You can stay for several years at a time. No more running to renew your visa every few months.

- You can sponsor your family. Your spouse, kids, and even parents can join you.

- You get the freedom to run a business, invest, or just live your life in Dubai.

Dubai’s investor visa is also a smart move if you want stability. You don’t have to worry about sudden exits or unstable rules. As long as you keep up your investment, you can call Dubai home.

Think of it as your all-access pass to the city’s business, lifestyle, and travel perks. Whether you’re aiming for a passive investment or want to launch the next big startup, this visa gives you options.

Next, we’ll look at who can actually get this visa—and what you’ll need to qualify.

Who Can Apply for the Dubai Investor Visa?

You don’t need to be a millionaire to get your foot in the Dubai door. The investor visa is open to all sorts of people—as long as you’re ready to put your money to work. So, who can apply? Let’s break it down.

Basic Eligibility

- You’re over 18 years old.

- You have a clean criminal record.

- You pass a medical exam (nothing wild—just the usual).

- You make a qualifying investment in Dubai (we’ll explain your options below).

Investment Types: Active vs. Passive Investment

There are two main ways to qualify:

Active investment means you’re involved in running a business or company.

Passive investment means you invest in something like real estate or government-approved funds and don’t need to manage it day-to-day.

Here’s a quick look at common ways to qualify:

| Type of Investment | Minimum Amount | What Counts? | Is it Passive? |

| Property Investment | AED 2 million | Residential property (apartment, villa, etc.) | Yes |

| Business/Company | AED 500,000+ | Shares in a Dubai-based company | Sometimes |

| Government Funds | AED 2 million | Investment in approved UAE funds | Yes |

| Start-Up or Innovation | AED 500,000+ | Approved tech, innovation, or start-up | Usually active |

Amounts may change, so always check the latest rules for 2025.

Passive Investment Explained

Not interested in running a company? No problem. Many expats choose the passive investment route, putting their money into property or funds. You don’t have to manage tenants or worry about day-to-day business. Just keep your investment in place and enjoy your Dubai residency.

Who Else Qualifies?

- Entrepreneurs launching new businesses in Dubai.

- Remote investors applying from outside the UAE.

- Existing property owners who upgrade their investment to meet the threshold.

The Dubai investor visa is designed to be flexible. Whether you want to build something from scratch, invest and relax, or try a bit of both, there’s an option for you.

Dubai Investor Visa Options

Dubai doesn’t believe in a one-size-fits-all approach. You’ve got choices when it comes to how you invest—and each comes with its own perks. Let’s look at the most popular ways to get a Dubai investor visa.

1. Property Investment Visa

This is one of the easiest and most popular options.

If you buy property in Dubai worth at least AED 2 million (about $545,000), you can qualify for an investor visa. It can be a single property or several that add up to the minimum amount.

Why choose property?

- You don’t have to manage a business.

- Property values in Dubai have shown steady growth.

- You can rent out your property for extra income (passive investment at its best).

Key points:

- The property must be fully paid (no big outstanding loans).

- Off-plan properties (still under construction) don’t always qualify—check the rules.

- Joint ownership is possible, but each person’s share must meet the minimum amount.

2. Company/Business Investment Visa

If you’re more of an entrepreneur, you can invest in or start a company in Dubai.

This option starts at around AED 500,000, but the exact amount depends on the type and size of your business.

Why choose a business investment?

- You can operate and profit from your own company.

- Dubai has free zones with extra benefits for foreign investors.

- Good for those wanting to be hands-on.

Key points:

- Your business needs to be registered in Dubai.

- You can apply as a shareholder or a sole owner.

- Some sectors have special rules, so always double-check.

3. Start-up and Innovation Visa by Investment

Got a bright idea or a unique start-up? Dubai offers visas for those who invest in innovation and tech.

Why go this route?

- Lower minimum investments (from AED 500,000).

- Encourages creativity and tech innovation.

- You get support from government incubators and hubs.

Key points:

- Your idea usually needs approval from a recognized Dubai incubator or authority.

- You must show a business plan and potential for growth.

Here’s a table to make your choices clear:

| Visa Option | Minimum Investment | Active/Passive | Family Sponsorship | Popular With |

| Property Investment | AED 2 million | Passive | Yes | Expats, retirees |

| Business/Company | AED 500,000+ | Active | Yes | Entrepreneurs |

| Start-up/Innovation | AED 500,000+ | Active | Yes | Innovators, founders |

In short, Dubai gives you flexibility. Whether you want to invest and chill, launch the next big thing, or just have a solid backup plan, there’s a path for you.

How to Apply for a Dubai Investor Visa

You don’t need to move mountains to get started. Dubai has made it easy, even if you’re applying from halfway around the world. Here’s what the process looks like—step by step.

Step-by-Step Guide

1. Choose Your Investment Option

- Decide if you’re going with property, business, or a start-up.

- Make sure your investment meets the minimum requirements.

2. Gather Your Documents Typical documents include:

- Passport (valid at least six months)

- Proof of investment (property title deed, business license, etc.)

- Bank statements

- Passport photos

- Medical insurance

- Police clearance certificate

3. Submit Your Application

- You can do this online or through a registered service provider in Dubai.

- Many investors use specialized visa agencies or legal firms to handle paperwork.

4. Medical Test and Background Check

- All applicants must pass a basic health screening.

- Background checks are required—usually a police certificate from your home country.

5. Pay the Fees

- Application fees depend on the visa type and processing speed.

- There may be additional costs for medical exams and document attestation.

6. Wait for Approval

- Processing times can range from a few days to several weeks, depending on your case.

7. Receive Your Investor Visa

- Once approved, you’ll get your residency stamped in your passport or a digital Emirates ID.

- You can now live, work, and sponsor your family in Dubai.

Remote Application: Apply from Anywhere

Not in Dubai yet? No problem.

The process is designed to let you apply from your home country. You don’t need to fly over until your visa is ready. Here’s how remote application works:

| Step | What You Do Remotely | Notes |

| Choose Investment | Research and invest online | Property, funds, or company shares |

| Document Preparation | Scan and email documents | Original copies needed on arrival |

| Application Submission | Use Dubai government e-portals/agencies | Trusted agents can handle this for you |

| Background Checks | Get police clearance locally | Attach with your application |

| Pay Fees | Online payment | Keep receipts for your records |

| Final Approval | Wait for email/notification | Entry permit issued to travel to Dubai |

You only need to travel once your visa is approved or for the final step (Emirates ID and medical).

Fees and Costs

Here’s a ballpark idea of what you’ll spend:

| Cost Item | Amount (USD) |

| Visa Application Fee | $1,000 – $1,500 |

| Medical Test | $100 – $200 |

| Emirates ID | $100 – $200 |

| Legal/Service Fees | Varies |

Actual costs depend on the type of visa and service provider.

Passive Investment: What You Need to Know

Not everyone wants to run a business day-to-day. Some people just want their money to work for them while they enjoy everything Dubai has to offer. That’s where passive investment comes in—and it’s a big reason why the Dubai investor visa is so popular.

What is Passive Investment?

A passive investment is just what the name implies—you invest your money in an asset that generates returns without requiring your active involvement in daily operations. In Dubai, the most popular passive investment options for securing an investor visa include real estate and government-approved investment funds.

Popular Passive Investment Options in Dubai

| Passive Investment Type | Minimum Investment | Description | Typical Returns |

| Real Estate (Property) | AED 2 million | Buy residential or commercial property in Dubai | Rental income, potential appreciation |

| Government/Corporate Funds | AED 2 million | Invest in approved UAE investment funds | Dividends, growth |

| Company Shares | AED 500,000+ | Hold shares in a Dubai-registered company | Profit share |

Why Go Passive?

- Hands-Off: No need to run a business or deal with daily operations.

- Steady Returns: Rental income from property, or dividends from funds.

- Flexibility: You can live in Dubai, rent out your property, or simply hold your investment.

Pros and Cons of Passive Investment

| Pros | Cons |

| Simple application process | Property market can fluctuate |

| Potential for stable income | Long-term commitment required |

| No need for business experience | Not all investments are risk-free |

| Family can be sponsored | Minimum investment must be maintained |

Example: How a Passive Investment Visa Works

Say you buy an apartment in Dubai worth AED 2 million.

With the Golden Visa UAE, you gain long-term residency, the ability to sponsor your family, and the option to rent out your property for passive income. There’s no need to launch a business, hire employees, or even live in the property unless you choose to.

For those who prefer a hands-off approach, investing AED 2 million in an approved UAE investment fund qualifies you for the UAE Golden Visa. Your funds are professionally managed, making the process smooth and stress-free.

Passive Investment: What You Need to Know

Not everyone wants to run a business day-to-day. Some people just want their money to work for them while they enjoy everything Dubai has to offer. That’s where passive investment comes in—and it’s a big reason why the Dubai investor visa is so popular.

What is Passive Investment?

A passive investment is exactly what it sounds like. You put your money into something that can earn returns, but you don’t need to be involved in the day-to-day management. In Dubai, the most common passive investments for the investor visa are real estate and government-approved investment funds.

Popular Passive Investment Options in Dubai

| Passive Investment Type | Minimum Investment | Description | Typical Returns |

| Real Estate (Property) | AED 2 million | Buy residential or commercial property in Dubai | Rental income, potential appreciation |

| Government/Corporate Funds | AED 2 million | Invest in approved UAE investment funds | Dividends, growth |

| Company Shares | AED 500,000+ | Hold shares in a Dubai-registered company | Profit share |

Why Go Passive?

- Hands-Off: No need to run a business or deal with daily operations.

- Steady Returns: Rental income from property, or dividends from funds.

- Flexibility: You can live in Dubai, rent out your property, or simply hold your investment.

Pros and Cons of Passive Investment

| Pros | Cons |

| Simple application process | Property market can fluctuate |

| Potential for stable income | Long-term commitment required |

| No need for business experience | Not all investments are risk-free |

| Family can be sponsored | Minimum investment must be maintained |

Example: How a Passive Investment Visa Works

Say you buy an apartment in Dubai worth AED 2 million.

You get a residency visa, you can sponsor your family, and you can rent out the property for extra income. You don’t have to start a business, hire staff, or even live in the property if you don’t want to.

If you prefer funds, you invest AED 2 million in an approved UAE investment fund. You receive your investor visa, and your money is managed for you.

Dubai Visa by Investment: 2025 Updates

Dubai’s investor visa landscape has evolved significantly in 2025, introducing new categories, adjusted investment thresholds, and streamlined processes to attract a broader range of investors and professionals. Here’s what’s new:

1. Expanded Eligibility for the Golden Visa

The UAE’s Golden Visa program now encompasses a wider array of professionals and investors:

- Educators and Researchers: Outstanding teachers and researchers in Dubai’s educational institutions can now qualify for a 10-year Golden Visa, recognizing their contributions to the sector.

- Gaming Industry Professionals: Under the Dubai Program for Gaming 2033, individuals in the gaming sector can obtain a 10-year Golden Visa, positioning Dubai as a global gaming hub.

- Luxury Yacht Owners: Abu Dhabi’s ‘Golden Quay’ initiative offers a 10-year Golden Visa to owners of luxury yachts, enhancing the emirate’s appeal to high-net-worth individuals.

2. Adjusted Investment Thresholds

Investment requirements have been updated to make the investor visa more accessible:

- Real Estate Investment: Investors can now obtain a 10-year Golden Visa by purchasing property worth at least AED 2 million (approximately $545,000).

- Public Investment Funds: A minimum investment of AED 2.5 million in accredited public investment funds is required for eligibility.

3. Enhanced Flexibility and Benefits

The updated investor visa policies offer greater flexibility:

- Family Sponsorship: Visa holders can sponsor their spouses, children, and, in some cases, parents, facilitating family relocation.

- Extended Stay Outside UAE: Golden Visa holders can now stay outside the UAE for more than six months without affecting their residency status.

- Simplified Application Process: The application procedures have been streamlined, with most steps now available online, reducing processing times.

These 2025 updates to Dubai’s investor visa program reflect the UAE’s commitment to attracting diverse talents and investments, making it an opportune time for potential investors to consider this pathway.

Tips for a Smooth Application

Applying for the Dubai investor visa doesn’t have to be stressful. A bit of planning and attention to detail goes a long way. Here are some tried-and-true tips to make the process easier and avoid common mistakes.

1. Double-Check Your Investment

- Make sure your investment meets the minimum amount required for the visa in 2025.

- For property, get a copy of the title deed and ensure the property is fully paid up.

- If investing in a business or fund, have official documentation ready.

2. Get Your Documents in Order Early

- Start gathering documents before you begin your application—passport, proof of funds, title deeds, bank statements, photos, and insurance.

- Check that your documents are valid, up-to-date, and meet Dubai’s requirements.

- Certified translations are needed if any documents are not in English or Arabic.

3. Use Reputable Service Providers

- If you’re not in Dubai, consider using a licensed visa consultant or agency—they know the process inside out.

- Avoid unregistered agents and deals that seem too good to be true.

4. Be Accurate and Consistent

- Fill out forms carefully. Small mistakes or inconsistencies can slow down your application.

- Your investment details should match across all paperwork.

5. Prepare for Health and Background Checks

- Book your medical test at an approved Dubai facility as soon as you arrive.

- Get your police clearance certificate from your home country ahead of time.

6. Track Deadlines and Fees

- Know your deadlines for submitting documents, especially if you’re applying remotely.

- Keep receipts for all payments.

- Budget for extra costs, like legal fees, not just the visa fee itself.

7. Choose the Right Investment for You

- If you want a hands-off approach, consider passive investment (like property).

- If you want to be hands-on, a business investment might suit you better.

- Don’t rush—compare your options and read the latest rules for 2025.

8. Get Professional Advice if Unsure

- Dubai’s laws and rules can change. If anything’s unclear, talk to a legal expert or financial advisor who knows the UAE system.

- An initial consultation is often worth the small extra cost.

Quick Checklist Table

| Step | Why It Matters |

| Verify investment amount | Avoids rejection on technical grounds |

| Organize documents early | Prevents last-minute delays |

| Use trusted professionals | Cuts down on errors and scams |

| Double-check forms | Stops small errors from causing big issues |

| Plan for extra costs | No budget surprises |

| Ask for help if unsure | Keeps your application on track |

A little preparation makes all the difference. Get these basics right, and you’ll have your Dubai investor visa in hand without unnecessary stress.

Final Notes

If you’re considering making Dubai your new home base through the investor visa, the opportunities are vast and the process is increasingly streamlined. Whether you’re eyeing property investments, business ventures, or innovative startups, Dubai offers a dynamic environment for growth and prosperity.

For individuals exploring international relocation and citizenship by investment UAE opportunities, Expatriate Global emerges as a trusted and comprehensive resource. With expertise in citizenship by investment, tax optimization, and asset protection, the firm delivers customized solutions to support your global mobility and financial strategies. Their experienced professionals offer personalized guidance, ensuring a smooth transition to Dubai while aligning your move with long-term financial and investment goals.

To explore how Expatriate Global can assist you in securing a Dubai investor visa and optimizing your global strategy, visit their official website.

Embark on your journey to Dubai with confidence, knowing that expert support is available to guide you every step of the way.