Curious to know how you can open a bank account in Dubai remotely? We’re answering all your questions in this blog.

Dreaming of banking in Dubai without stepping on a plane? You’re not alone. With its tax benefits, solid financial system, and global appeal, Dubai has quietly become a top choice for savvy entrepreneurs, freelancers, and investors around the world.

But here’s the good news, you can open a bank account in Dubai remotely. Yep, no need for dusty paperwork or booking a flight. Things have changed. Technology, flexible banking rules, and digital-first services have made it possible to handle the whole process from your couch.

Whether you’re building a remote business, managing international income, or just want access to a UAE account, this guide has you covered. We’ll walk you through every step. Simple, clear, and with no fluff. So, let’s unlock the secrets of Dubai banking, the remote way.

Why Open a Bank Account in Dubai Remotely?

Opening a bank account used to mean long queues, endless paperwork, and, in some cases, flights halfway across the world. But not anymore. Especially if we’re talking about Dubai, where digital banking has taken a serious leap forward.

So, why should you even think about doing this remotely?

A Global Financial Hub at Your Fingertips

Dubai isn’t just about luxury shopping and skyscrapers. It’s now a powerful financial center connecting the East and West. Opening a bank account here gives you access to a solid, well-regulated banking system that’s trusted worldwide.

And the best part? You don’t need to be physically in the UAE to tap into it. When you open a bank account in Dubai remotely, you’re unlocking a gateway to international banking. Without leaving your home.

Tax Benefits and Financial Freedom

One of Dubai’s biggest draws is its zero personal income tax policy. That’s right. No taxes on your salary, investments, or savings. For entrepreneurs, freelancers, and global business owners, this is a game-changer.

And because Dubai’s banks support multiple currencies, you can manage your international earnings with ease. No more constant conversions or high transfer fees eating into your income.

Remote Work and Location Independence

Remote work is here to stay. If your business lives in the cloud, your bank should too. Being able to run everything online, including your finances, gives you serious freedom.

Want to invoice clients from Bali, invest from Lisbon, and save in Dubai? Totally doable. You don’t need to be a resident, and you don’t need to visit. That’s the beauty of modern banking in the UAE.

Privacy, Stability, and Security

Dubai banks are known for their strict compliance and high security standards. Your funds are not only safe. They’re protected by one of the region’s most stable economies. If you value financial privacy and peace of mind, you’re in the right place.

In a Nutshell…

Whether you’re building a global business or just looking for a more flexible way to manage your money, choosing to open a bank account in Dubai remotely is more than smart. It’s future-ready.

So why not bank where the world does business?

Can You Really Do It Without Being There?

So, let’s cut to the chase. Is it actually possible to open a bank account in Dubai remotely? No airport runs, no visa stamps, no office visits. Just your laptop, some documents, and a bit of patience.

Short answer: Yes. Absolutely.

Longer answer: Yes. And it’s more common than you think.

The Old Way vs. The New Way

Traditionally, opening a bank account in the UAE meant you had to be physically present. In some cases, banks even required a residency visa, local utility bills, and a face-to-face meeting with a banker in a glassy office tower.

That was then.

Now? Many banks in Dubai have embraced digital onboarding, especially after the pandemic pushed everyone toward remote everything. They’ve streamlined their systems. Video calls replaced in-person meetings. Scanned documents replaced hard copies. And digital signatures now do the job of handshakes.

So, Is It Legal?

One hundred percent. Dubai’s banking sector is highly regulated. So while the process is legit, it still follows strict KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. This means you’ll need to provide clear proof of identity, income, and address. But you don’t need to be in the country to do it.

In fact, many banks offer specific services aimed at non-residents and international entrepreneurs. Some even have special departments to help remote applicants from start to finish.

Do I Need a UAE Residency?

Not necessarily. Plenty of banks offer non-resident accounts, especially if you’re opening one for business purposes or through a UAE-registered company. That said, having a Free Zone company or a local partner can speed things up and expand your options.

Still, even without residency, it’s very possible to open your UAE account. As long as you’re transparent, prepared, and working with the right bank.

So, What’s the Catch?

Honestly? Just the paperwork. You’ll need to get everything right, possibly notarized or attested, depending on the bank. But once that’s done, the rest can happen from your home office or beach chair. Plus, not every bank offers this facility. So, you need to look out for the ones that do.

So yes, you can open a bank account in Dubai remotely. And you don’t need to pack a bag to do it.

Documents That You’ll Need to Open UAE Account

Alright, let’s get to the practical part. You’re ready to open a bank account in Dubai remotely, but before you dive in, you’ll need to gather a few things. Don’t worry. It’s not as overwhelming as it sounds. Think of it as packing a digital suitcase.

Here’s your simple, no-stress checklist.

1. Valid Passport

This one’s a no-brainer. Your passport should be clear, up-to-date, and not expiring anytime soon. Some banks might ask for a notarized copy, so keep a scanned version ready. Just in case.

2. Proof of Address

Banks want to know where you live. Even if it’s not in Dubai. This could be a utility bill, bank statement, or official government letter. Just make sure it’s recent (usually within the last 3 months) and shows your full name and address clearly.

Bonus tip: Digital statements work fine for most banks.

3. Proof of Income or Source of Funds

They’re not being nosy. They’re just following global anti-money laundering rules. You might be asked to show:

- A salary certificate

- Employment contract

- Business license (for entrepreneurs)

- Recent tax return or bank statements

Basically, anything that explains how you earn and manage your money.

4. Bank Reference Letter (Optional)

Not every bank asks for this, but having one can smooth the process. It’s a letter from your current bank confirming you’re a legit client in good standing. Simple, yet effective.

5. Business-Related Documents (If Applicable)

Planning to open a corporate account? You’ll need:

- Your company’s trade license

- Certificate of incorporation

- Shareholder list

- Passport copies of partners or owners

Some banks may also request a business plan or website link. So have your digital footprint in order.

Pro Tip:

Scan everything in high quality and keep digital copies organized in one folder. That way, you’ll fly through the application process without breaking a sweat.

So yes, the paperwork exists. But it’s manageable. Once you’ve got everything in place, you’re well on your way to open a bank account in Dubai remotely, without a single airport visit.

Ready to explore which banks offer remote UAE account facility? Let’s keep going.

Best Banks in Dubai That Offer Remote UAE Account Opening

So, you’ve got your documents ready. You’re all set to open a bank account in Dubai remotely. But now comes the big question: Which bank should you pick?

Dubai has a wide range of banks, but not all of them make the remote process smooth. The good news? A few stand out for being digital-friendly, efficient, and open to non-residents.

Let’s check out the top contenders.

Emirates NBD

Emirates NBD is one of the biggest and most trusted banks in the UAE. They offer remote account opening through their business banking platform, especially for freelancers and entrepreneurs setting up in free zones.

Their mobile app is sleek, and customer service? Pretty responsive. Just make sure you meet their minimum deposit requirements, which vary based on the account type.

Mashreq Neo

Want full digital vibes? Mashreq Neo is your go-to option. It’s one of the first “neo-banks” in the region. Meaning everything happens online. No branches. No paper. Moreover, no old-school processes.

Opening an account remotely is straightforward, especially if you’re working with a UAE-based business setup partner. They even have international account options for non-residents, which is a huge plus.

RAKBANK

RAKBANK (or the National Bank of Ras Al Khaimah) is another strong option for remote banking. They offer tailored services for small businesses, startups, and individuals living abroad.

With RAKBANK, the onboarding process is pretty flexible, and they’re known for competitive fees and solid support. Bonus: Their website is super informative and user-friendly.

WIO Bank

This one’s fresh, modern, and built for the digital-first generation. WIO Bank is a newer name, but it’s backed by big players and fully licensed by the Central Bank of the UAE.

What makes WIO special? You can literally open an account from your phone. It’s all app-based, and they’re especially popular with freelancers, solopreneurs, and tech-savvy expats.

Ultimately, if you’re planning to open a bank account in Dubai remotely, these banks are your best bet. Each offers a slightly different experience, but all embrace digital-first banking and remote onboarding.

Pick the one that fits your needs and say goodbye to boring bank visits.

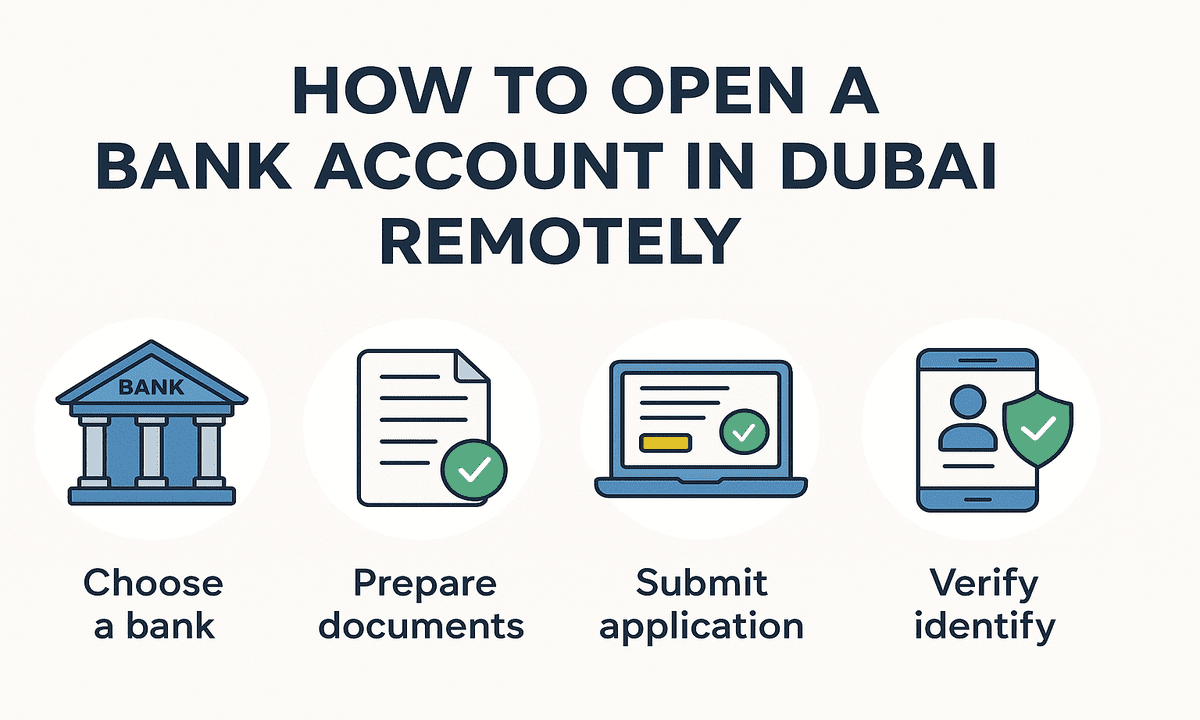

How to Open a Dubai Bank Account Remotely in 6 Simple Steps

Step 1: Choose the Right Bank for You

Not all banks are created equal. Some cater to freelancers. Others lean toward corporate clients or residents only. So start with a bit of research.

Ask yourself:

- Do I want a personal or business account?

- Am I a resident or applying from abroad?

- Do I need multi-currency features or just AED?

- What’s the minimum deposit requirement?

Once you know what you’re looking for, shortlist banks that meet those needs. Like Mashreq Neo, WIO, or RAKBANK.

Step 2: Contact the Bank or a Business Setup Partner

Now it’s time to make contact.

Most banks will have a form on their website to request a callback or initiate the application. If you’re applying as a business owner or entrepreneur, you might get faster results by working with a UAE business setup agency. They often have direct access to bank reps.

Either way, you’ll be speaking to a real person soon.

Step 3: Submit Your Documents

Remember that handy document checklist we went through earlier? This is where it comes in.

Upload clear, high-quality scans of:

- Your passport

- Proof of address

- Proof of income or business license

- Any additional forms the bank sends you

Some banks also require a selfie or video verification to complete your Know Your Customer (KYC) process. Don’t worry. It’s as easy as a video call or uploading a quick selfie holding your ID.

Step 4: Wait for Initial Review

Once your documents are submitted, the bank will review everything. This step usually takes anywhere from a couple of days to a week. Sometimes longer, depending on the bank’s internal checks and the type of account you’re applying for.

They may get back to you with follow-up questions or request additional documentation. It’s pretty normal, so don’t stress it.

Step 5: E-Sign the Agreement

If everything checks out, you’ll receive your account approval via email.

Now it’s time to sign the bank’s agreement forms. In most cases, you’ll receive them electronically via DocuSign or a similar platform. Sign, send, and you’re done!

Step 6: Fund Your Account & Go Live

Once your account is open, you’ll usually be asked to deposit the minimum opening balance. This could range from zero (in rare cases) to AED 10,000 or more. After that, your account is fully active. You’ll receive your online banking credentials, and in many cases, a debit card is shipped to your address or available for pick-up.

And just like that, you’ve managed to open a bank account in Dubai remotely, without ever stepping foot in the UAE.

To make the process even smoother, ensure:

- Your name and details match across every file

- You respond to the bank’s emails quickly, they love that

- You use a business setup consultant (they can seriously fast-track things)

Here at Expatriate Global, we provide a Done-For-You service in this regard, especially for entrepreneurs.

So, there you have it. A remote, modern, and surprisingly smooth way to open a Dubai bank account. No long queues. No plane tickets. Just a few smart steps and a strong Wi-Fi connection.

Should You Open a UAE Account Under a Free Zone Company?

Here’s a question that pops up a lot: “Do I need a company in the UAE to open a bank account remotely?”

And more specifically, Should it be a Free Zone company?

Let’s unpack that.

What Is a Free Zone Company, Anyway?

First, let’s clarify what a Free Zone company actually is. In Dubai (and the UAE as a whole), Free Zones are special business areas where foreign entrepreneurs can own 100% of their company. Without needing a local sponsor.

That’s a huge deal.

Plus, Free Zones come with perks like:

- Tax advantages

- Easy company setup

- Access to visas (if needed)

- Minimal paperwork

And the best part? Many of them allow you to set up your business without being physically present. Remote setup + remote banking = dream combo. And if you wish to learn more about them, then here we discuss Dubai business setup (including Free Zones) in detail.

Why Banks Prefer Free Zone Companies

When you’re looking to open a bank account in Dubai remotely, having a Free Zone company can give you a real edge.

Why? Because it shows the bank you’re serious. It proves you’ve got an official business presence in the UAE. Even if it’s virtual.

Banks feel more comfortable dealing with clients who are connected to the local system, even if only through a Free Zone registration. It gives your application more weight and, frankly, speeds things up.

What If You’re a Freelancer or Consultant?

Many Free Zones now offer freelance permits and solo entrepreneur licenses. You don’t need a big office or a team of employees. Just you, your laptop, and your dream.

This is perfect for digital nomads, remote workers, online consultants, and solopreneurs.

Once your freelance license is live, you can move forward to open a bank account in Dubai remotely. And you’ll have a stronger chance of approval, too.

So, Should You Go for It?

Short answer: Yes, if you’re planning to do business in the region. Or even if you just want a stronger foundation for remote banking.

Opening a Free Zone company is relatively affordable, depending on the zone you choose. Some packages even include help with setting up your bank account, which makes the process even easier.

However, if you just need a personal bank account with no business activity planned, you may not need a Free Zone setup. In that case, some banks still allow remote personal accounts, especially if you have proof of income or assets.

Thus, setting up a Free Zone company isn’t just about business. It’s a key that unlocks doors. Especially if you’re trying to open a bank account in Dubai remotely. It gives you structure, credibility, and a smoother path through the UAE’s financial system.

Think of it as a smart investment in your global lifestyle.

Security, Regulations & Tax Implications of UAE Accounts

Let’s be honest. When it comes to money, the where and how matters just as much as the how much. And if you’re planning to open bank account in Dubai remotely, it’s only natural to wonder: Is it safe? Are there any strings attached? What about taxes?

Great questions. Let’s dive in.

Is My Money Safe in Dubai?

In a word—Yes.

Dubai takes financial security very seriously. The UAE’s banking system is highly regulated by the Central Bank of the UAE, which keeps a close eye on everything from compliance to cybersecurity.

Most banks use advanced encryption, two-factor authentication, and secure online portals. So, even if you’re miles away, your money isn’t. Banks in Dubai are known for their stability. The region’s economy is strong, and the government has strict rules in place to protect depositors.

So yes, your money is in good hands.

Playing by the Rules

When you open bank account in Dubai remotely, you’ll still need to follow all the local rules and international regulations. This includes things like:

- KYC (Know Your Customer) compliance

- Source-of-funds documentation

- Background checks for corporate accounts

It might sound like a lot, but it’s mostly about making sure you’re not a mystery to the bank. Once they know who you are and what you do, things usually move along pretty smoothly.

What About Taxes?

Here’s the exciting part. The UAE has no personal income tax.

That’s right. If you’re not living in a country that taxes your global income, you could potentially keep more of what you earn. But keep in mind, your home country might still want a slice, so always check with a tax advisor.

Also, corporate taxes are starting to roll in (as of 2023), but only for businesses with profits above a certain threshold. If you’re a small business or freelancer, you might be in the clear.

So, can you open bank account in Dubai remotely and still stay secure, legal, and tax-smart? Absolutely. Just follow the steps, play by the rules, and don’t forget to get a bit of expert advice along the way.

FAQs About Opening a Bank Account in Dubai Remotely

Still got questions buzzing in your head? No worries. Let’s clear things up with a quick FAQ round. Short, snappy, and straight to the point.

Can I do it as a tourist or non-resident?

Yes, you can! Several banks in Dubai now allow non-residents—and even tourists—to open accounts remotely. However, the process might be slightly more detailed, and some banks could ask for extra paperwork. A Free Zone company setup can also boost your chances if you’re not a resident.

How long does it take to get approved?

It depends on the bank, but in most cases, approval can take anywhere from a few days to a couple of weeks. Some digital banks are faster, while traditional ones may take their time verifying everything. Just be ready with your documents. It’ll speed things up.

Do I need to visit later for verification?

Not always. Many banks now complete the entire process online, including identity verification via video call or certified documents. However, a few might still ask for a visit down the line. Especially if you’re applying for a business account with large transactions.

Can I receive international transfers?

Absolutely. Once your account is active, you can receive international payments without any issues. Dubai banks are globally connected, and most offer multi-currency accounts too. Just make sure you understand any charges involved with incoming international wires.

Are there any hidden fees?

Most banks are transparent, but yes. There can be minimum balance rules or account maintenance fees. It’s always wise to read the fine print (or ask directly).

Have more questions? That’s totally normal. But one thing’s for sure. When you open bank account in Dubai remotely, you’re unlocking access to one of the world’s most international banking hubs.

Final Thoughts

Yes, you can open a Dubai bank account remotely — no flights, no queues, no stress. Banking has gone global, and Dubai leads the way.

Dubai’s financial system is advanced, secure, and designed for international clients. Whether you’re a digital nomad, entrepreneur, or simply seeking a safe place for funds, Dubai welcomes you.

Gather the right documents, follow the process carefully, and stay patient. Within days, you can access a fully operational Dubai bank account from anywhere.

Choose the right bank based on your needs. Compare fees, online services, and international transfer options. Stay clear about your goals before applying.

Once your account is active, enjoy seamless transactions, global access, and the benefits of banking in one of the world’s top financial hubs — all from your living room.

So, are you ready to move your money the Dubai way?