Curious to learn about how to start a holding company in Dubai? Here’s all that you need to know.

Imagine a place where skyscrapers kiss the clouds, laws favor businesses, and taxes don’t eat your profits. That’s Dubai. Over the last decade, it’s transformed into a global magnet for entrepreneurs, investors, and visionaries looking to expand their empires. Many of them looking forward to Dubai business incorporation.

But here’s the thing. While many rush to launch startups or open retail outlets, savvy business minds go one step further. They set up holding companies. Why? Because holding companies offer control, protection, and unmatched flexibility. And if you want to do it right, there’s no better place than Dubai.

In this guide, we’ll show you exactly how to start a holding company in Dubai. Step by step. We’ll also unpack what a holding company is, where to set it up, and why expert help can save you tons of stress.

What Is a Holding Company?

Before we explore how to start a holding company in Dubai, let’s clear up what exactly it is.

So, a holding company isn’t your typical business. It doesn’t sell products. It doesn’t offer services. And it probably doesn’t have a bunch of employees running around. Instead, it holds things. Assets, shares, and ownership stakes in other companies.

Think of It Like the Parent of a Business Family

A holding company is like the head of a family that owns multiple businesses. Each “child” company might operate in a different industry. Real estate, tech, manufacturing, you name it. But they all report to the same parent.

This parent doesn’t do the day-to-day work. Instead, it watches over, controls, and protects its children. Neat, right?

What Does It Hold?

A holding company can own:

- Shares of other companies

- Intellectual property (like trademarks and patents)

- Real estate and physical assets

- Equipment and vehicles

- Bankable investments

Basically, it’s a legal way to control wealth and manage risk. All while keeping things neat and organized.

Not Just for the Big Players

Here’s the cool part. You don’t need to be a billionaire to start one. Small business owners, freelancers, even property investors use holding companies to separate their assets, reduce liability, and plan for growth.

So if you’re thinking it’s just for giant corporations. Think again.

Why People Love This Setup

Holding companies protect your assets. They can also reduce your tax exposure, depending on where they’re registered. If one of your operating businesses fails, the holding company can shield your other assets from being dragged down with it.

And if you start a holding company in Dubai, you get to enjoy all of that. Plus the perks of a tax-friendly, global business environment.

Understanding the UAE’s Holding Company Structure

Dubai isn’t just about shiny skyscrapers and luxury shopping. It’s also home to one of the most business-friendly environments in the world. If you want to start a holding company in Dubai, you’re already on the right track.

But first, let’s break down how the UAE actually structures things behind the scenes.

UAE: The Ultimate Hub for Business Growth

The UAE has reshaped its laws to attract entrepreneurs, investors, and global corporations—and it worked. From tax benefits to strong legal protections, everything supports business growth with minimal friction.

The government also provides multiple zones and jurisdictions tailored to different business needs. Whether you’re managing assets, holding shares, or scaling ventures, there’s a structure built for you.

So, where can you establish a holding company? Let’s break it down.

1. Mainland Companies

Mainland companies operate under the UAE’s federal laws. They allow you to do business both inside and outside the UAE without restrictions. You can also own physical offices anywhere in the country.

- 100% foreign ownership (thanks to recent reforms)

- Access to local and international markets

- Slightly more regulation and reporting compared to other setups

Best for: Entrepreneurs who want complete market access across the UAE.

2. Free Zones (DMCC, IFZA, RAK ICC, and more)

Free zones are special economic areas that offer massive perks. Each zone has its own rules, authority, and sector focus. They’re known for speed, simplicity, and tax benefits.

- 100% foreign ownership

- Zero corporate or income tax

- No import/export duties within the zone

- Limited ability to trade directly in the mainland

Best for: International investors and asset managers who don’t need a physical presence across Dubai.

3. Offshore Jurisdictions (e.g., JAFZA Offshore, RAK ICC Offshore)

Offshore holding companies are perfect for asset protection and international investment. They’re ideal for holding shares in other companies or managing global assets without setting up a physical business. Here’s more on the advantages of setting up an offshore company in the UAE.

- 100% foreign ownership

- No physical office required

- Total privacy and confidentiality

- Can’t operate inside the UAE directly

Best for: Investors managing wealth, intellectual property, or global portfolios.

Let’s Compare: Mainland vs. Free Zone vs. Offshore

This table summarizes how each of these fare against the others.

| Feature | Mainland | Free Zone | Offshore |

| Ownership | 100% foreign (in most cases) | 100% foreign | 100% foreign |

| Local Operations | Yes | Limited | No |

| Tax Benefits | Partial | Full (0% tax) | Full (0% tax) |

| Regulatory Oversight | Moderate | Light | Very Light |

| Setup Cost | Medium | Low to Medium | Low |

| Privacy | Moderate | High | Very High |

What Should You Consider Before Choosing?

When you start a holding company in Dubai, your choice of jurisdiction matters. Think about:

- Ownership Control – Do you need full control, or are you okay with a local sponsor (rarely needed now)?

- Taxes – Do you want to minimize tax or stay tax-compliant globally?

- Compliance – Some structures require more paperwork and annual reporting.

- Flexibility – Will you be managing companies only in Dubai or across borders?

Now that you’ve got the lay of the land, let’s dive into the actual steps to build your holding company in Dubai from scratch.

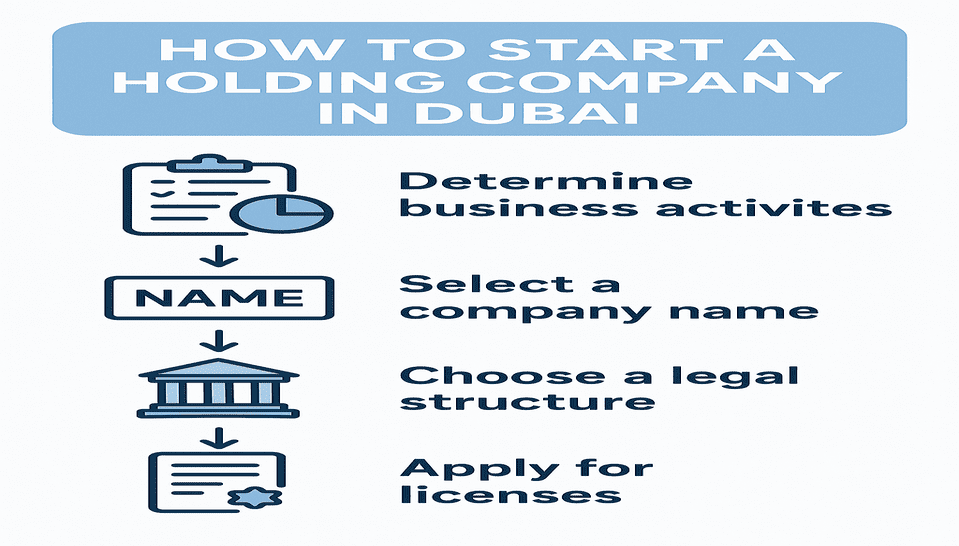

How to Start a Holding Company in Dubai: Step by Step Guide

So you’ve done the research, weighed your options, and decided this is the right move. You’re ready to start a holding company in Dubai. Great choice! But now comes the big question. How do you actually go about it?

Don’t worry. We’ve broken it down into clear, simple steps. No corporate jargon. No confusing detours. Just a straight path to getting your holding company off the ground. Let’s walk through it, one step at a time.

Step 1: Define Your Business Objectives

Before you fill out a single form or speak to any government official, pause and ask yourself: What is the purpose of my holding company? Will it:

- Own shares in multiple businesses?

- Hold real estate properties?

- Manage intellectual property like patents or trademarks?

- Serve as a global investment vehicle?

The answer matters. It shapes everything else. From your jurisdiction to your structure. Plus, a clear vision helps streamline the approval process. Authorities want to know your holding company isn’t just a shell. It has a purpose.

Tip: Write out a simple mission statement. It’ll come in handy when preparing your business plan.

Step 2: Choose the Right Jurisdiction

Dubai offers several jurisdictions, but not all of them work the same way. Where you set up will directly affect your tax exposure, reporting obligations, and operational freedom. Let’s break it down:

Mainland

Great for companies that plan to do business directly within the UAE. Offers 100% foreign ownership in most sectors. Slightly more paperwork, but full access to the local market.

Free Zones (like DMCC, IFZA, RAK ICC)

Perfect for holding assets or companies without engaging in UAE-wide commercial activity. Offers tax exemptions, fast setup, and full ownership.

Offshore (JAFZA Offshore, RAK ICC Offshore)

Ideal for international holdings. No office needed. Maximum privacy. But no trading inside the UAE.

Think about where your subsidiaries will operate and where your assets are located. That should guide your choice.

Step 3: Decide on a Legal Structure

Now it’s time to pick the legal skeleton of your company. Common options include:

- LLC (Limited Liability Company): Popular for mainland setups. Offers flexibility and limited liability.

- Private Joint-Stock Company: Better for large-scale holdings or if you plan to raise capital.

- Free Zone Entity: Varies by zone but often set up as an FZ-LLC. Fast and flexible.

- Offshore Entity: Used for global structuring. Simple setup, minimal maintenance.

The structure determines what you can do—and what you can’t—so choose wisely. If in doubt, speak with a legal advisor or business consultant.

Step 4: Select a Company Name

It might sound simple, but naming your company in Dubai comes with rules. Here’s what you can’t use:

- Anything offensive or blasphemous

- Names of countries or government entities

- Abbreviations (like “J&K Holdings”) unless you use full names

And here’s what you should do:

- Make it relevant to your business

- Ensure it’s unique in the registry

- End with “Holding” if it’s a holding entity

Always run a name availability check before locking in your brand.

Step 5: Prepare Required Documents

Now we’re getting into the paperwork. Don’t worry. It’s not overwhelming if you have everything ready. Common documents include:

- Passport copies of shareholders/directors

- Visa and Emirates ID (if you’re a UAE resident)

- Proof of address (like a utility bill)

- Business plan

- Memorandum of Association (MoA)

- Shareholder resolution (if needed)

Some jurisdictions may ask for additional details, but this is the core set.

Pro tip: Keep digital and hard copies ready. Authorities may ask for both.

Step 6: Submit Application to the Chosen Authority

Now it’s time to go. Submit your application to the relevant authority. Whether that’s a Free Zone authority, the Department of Economic Development (DED), or an offshore registrar. Each jurisdiction has its own process, but here’s what to expect:

- Document review: Authorities verify your info

- Approval: Usually takes 5 to 10 working days

- License issuance: Once approved, you’ll receive your holding company license

If you’re in a hurry, some Free Zones offer fast-track options. Just be prepared to pay a premium.

Step 7: Open a Corporate Bank Account

This step can be trickier than it sounds. UAE banks are strict when it comes to corporate accounts. Especially for holding companies. Be prepared for:

- A detailed compliance check

- In-person meetings

- Questions about your company’s purpose and financial flows

- But don’t panic. You can make this process smoother by:

- Working with a business consultant

- Choosing a bank familiar with holding structures

- Keeping your paperwork neat and complete

Note: Some Free Zones also partner with banks to help you open accounts faster.

Step 8: Set Up Subsidiaries (If Any)

Once your holding company is up and running, you can begin registering your subsidiaries. These are the operating businesses or asset vehicles your holding company will own. You can set them up in different jurisdictions, depending on what each one needs to do. For example:

- A retail company might go under the mainland license

- A tech startup might benefit from a Free Zone like Dubai Internet City

- An international IP company could be placed offshore

The beauty of a holding company is flexibility. You can structure your empire exactly how you want. While keeping control at the top.

Wrapping Up This Section

There you have it. A clear, human-friendly roadmap to start a holding company in Dubai. No legalese. No fluff. Just the real steps you need to take, in the right order. Up next, let’s look at how professional consultants can take all this off your plate. And help you avoid the bumps that most first-timers hit. Trust us, it’s a shortcut worth considering.

The Role of Professional Consultants

Starting any company in a foreign country can feel overwhelming. Rules. Documents. Delays. It’s easy to get lost in the process. That’s where professional consultants come in. If you’re planning to start a holding company in Dubai, they can be your secret weapon.

Why Do It Alone?

Sure, you can figure it all out yourself. But should you?

Setting up a holding company involves legal paperwork, compliance steps, licensing, and coordination with different government bodies. Each jurisdiction has its own playbook, and missing even one requirement could delay your launch or lead to rejections.

Now imagine handing all of that off to someone who’s done it a hundred times before.

What Do Consultants Actually Do?

Here’s the short answer: they do the heavy lifting so you don’t have to. From day one, a reliable business setup consultant will:

- Help define your business goals clearly

- Recommend the best jurisdiction for your needs

- Handle all legal paperwork and documentation

- Act as a direct liaison with the relevant government authorities

- Secure your licenses and approvals smoothly

- Assist with opening corporate bank accounts

- Even help set up your subsidiaries later on

And that’s not all. They also guide you around common pitfalls. So you save time, avoid stress, and cut down unnecessary costs.

Worth the Investment? Absolutely.

Yes, there’s a fee. But when you consider the potential delays, fines, or re-submissions you’d face going solo, consultants often save you more than they cost. Plus, you get peace of mind knowing things are being handled the right way from the start.

Especially if this is your first time setting up a structure in Dubai, expert guidance can make all the difference.

Choosing the Right Partner

Dubai has no shortage of consulting firms. So, how do you choose? Look for experience, transparency, and client reviews. The best firms will treat your company like their own and keep you in the loop every step of the way.

Quick Spotlight: Expatriate Global

We offer full-service business setup consultancies in the UAE. Our “Done-For-You” solution covers everything. From strategic planning to legal structuring to hand-delivering your license. It’s as hands-off as it gets, and perfect for busy founders who want to focus on the bigger picture.

In short, if you want to start a holding company in Dubai without the headache, a trusted consultant isn’t just helpful. It is essential.

Benefits of Starting a Holding Company in Dubai

So, why do so many entrepreneurs, investors, and multinational firms rush to start a holding company in Dubai? It’s not just a trend. It’s a smart move. The city offers a long list of advantages that are hard to ignore. Let’s unpack the real perks that make Dubai a global hotspot for holding structures.

100% Foreign Ownership

First off, let’s talk control. In many Free Zones across the UAE, you can enjoy 100% foreign ownership. That means no local partner, no shared decision-making. Just full authority over your company. It’s your vision, your way. And yes, it’s perfectly legal.

Massive Tax Advantages

This one’s a biggie. Most Free Zones and offshore jurisdictions in Dubai offer 0% corporate and personal income tax. That’s right. Zero. You also avoid withholding taxes and capital gains taxes in most scenarios. So, more profits stay in your pocket, fueling faster growth and greater reinvestment.

Protect What’s Yours

Holding companies aren’t just about growth. They’re about asset protection too. By keeping ownership of various assets and subsidiaries under one umbrella, you limit liabilities and safeguard your wealth. If one business faces legal or financial trouble, the rest stay protected.

A Gateway to the World

Dubai is not just another city. It’s a global business gateway. With its international reputation, modern infrastructure, and open economy, holding a company here gives you access to new markets across Asia, Europe, and Africa. It’s a perfect springboard for expanding your reach without changing your base.

Built for Growth and Flexibility

Got multiple businesses? Thinking of acquiring more? No problem. A Dubai holding company makes it easy to manage multiple subsidiaries under a single structure. Whether you’re into tech, real estate, logistics, or retail, the framework is flexible and built for scale.

Double Taxation? Not Here.

Thanks to UAE’s network of Double Taxation Avoidance Agreements (DTAAs) with over 135 countries, you won’t be paying tax twice on the same income. This is a huge win for international investors and cross-border operators.

In a nutshell, if you’re ready to start a holding company in Dubai, you’re not just building a business. You’re securing a smarter, more efficient future.

Conclusion – Why Starting a Holding Company in Dubai Pays Off

Launching something new often feels like a leap of faith. In Dubai, that leap transforms into a powerful strategic move.

Dubai’s business-friendly ecosystem makes it the perfect place to protect assets, manage ventures, and expand globally with confidence.

If you’re considering a holding company in Dubai, now is the best time. The city offers unmatched opportunities for growth and security.

With a strong legal framework, world-class connectivity, and expert consultants, success becomes achievable at every stage of your journey.

Adding to this advantage, the UAE Golden Visa ensures long-term stability. It empowers investors, entrepreneurs, and business owners with lasting security.